Welcome to the world of Forex trading, where currencies are exchanged and fortunes can be made. For beginners, the idea of trading Forex might seem daunting, but with the right knowledge and tools, anyone can get started. In this guide, we will break down the essential elements of Forex trading in an easy-to-understand manner. For those in Uzbekistan looking for reliable options, check out the forex trading for dummies Best Uzbek Brokers.

What is Forex Trading?

Forex, or foreign exchange, is the market where currencies are traded. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike other markets, the Forex market operates 24 hours a day, five days a week, allowing traders to engage from anywhere at any time. The essence of Forex trading is to buy one currency while selling another, using currency pairs. For example, if you’re trading the EUR/USD pair, you would be buying euros and selling U.S. dollars.

Why Trade Forex?

There are several reasons to consider trading Forex:

- High Liquidity: Forex is the most liquid market, which means you can easily enter and exit trades.

- Leverage: Many brokers offer leverage, allowing you to control a larger position with a smaller amount of capital.

- Diverse Trading Options: Traders can choose to trade a variety of currency pairs based on their preferences.

- Accessibility: With just an internet connection, anyone can start trading Forex.

Getting Started with Forex Trading

Ready to dive into Forex trading? Here are the initial steps to get you started:

1. Educate Yourself

Before you start trading, it’s essential to gain knowledge about the Forex market. There are many free resources available online, including articles, tutorials, and forums. Books about trading psychology and technical analysis can also provide valuable insights.

2. Choose a Reliable Forex Broker

The next step is selecting a broker who suits your needs. Make sure to choose a regulated broker that offers a good trading platform, a variety of currency pairs, and competitive spreads. Research is vital; read reviews and check the broker’s reputation.

3. Open a Trading Account

Once you have chosen a broker, the next step is to open a trading account. Most brokers will offer demo accounts, which allow you to practice trading without risking real money. This is an excellent way for beginners to familiarize themselves with the trading platform and test their strategies.

4. Develop a Trading Plan

A solid trading plan is essential for success. It should outline your trading goals, risk tolerance, and strategies. Decide how much time you can dedicate to trading, the strategies you will use, and how you will manage your money.

Understanding Forex Terminology

Before you start trading, familiarize yourself with some key terms:

- Pips: The smallest price move in a currency pair.

- Lots: The volume of a trade, measured in lots. A standard lot is 100,000 units of currency.

- Spread: The difference between the buying and selling price.

- Margin: The amount of money required to open a position, often expressed as a percentage.

Developing Trading Strategies

There are various strategies you can employ when trading Forex:

1. Scalping

This strategy involves making numerous trades throughout the day, aiming for small profits on each trade.

2. Day Trading

Day traders open and close their positions within the same trading day, avoiding overnight risk.

3. Swing Trading

Swing traders hold positions for several days, aiming to profit from price swings.

4. Position Trading

Position traders hold trades for weeks or even months, focusing on long-term trends.

Risks of Forex Trading

While Forex trading can be profitable, it also comes with risks. It’s essential to understand these risks and manage them properly:

1. Market Risk

The largest risk is the volatility of the Forex market. Prices can change rapidly, leading to potential losses.

2. Leverage Risk

While leverage can amplify your profits, it can equally amplify your losses. Trade with caution and understand the implications of using leverage.

3. Psychological Risk

Emotions can impact trading decisions. It’s vital to stay disciplined and stick to your trading plan.

Forex Trading Tools

There are several tools that traders can use to enhance their Forex trading experience:

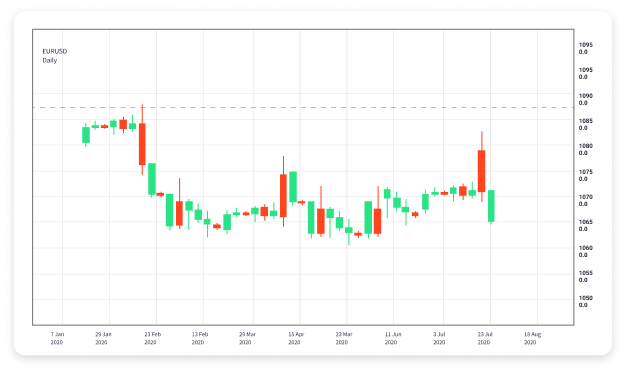

- Charting Software: Tools that help you analyze price movements.

- Economic Calendars: Keeping track of economic events can help inform trading decisions.

- Trading Journals: Documenting trades can provide insights for improvement.

Conclusion

Forex trading for dummies may seem overwhelming at first, but with proper education, a disciplined approach, and the right tools, anyone can become a successful trader. Remember, practice makes perfect; take your time to learn and develop your strategies. Whether you aim for short-term gains or long-term investments, the world of Forex holds plenty of opportunities for dedicated traders.